In today’s world, life almost always revolves around credit. The things we buy, the vacations we take, the gifts we give away are at one stage or another, linked to credit. This is one reason why extending credit to customers should be a meticulous process. A credit application template is a very important document used to control credit risks when extended to customers and at the same time, protecting the company.

Contents

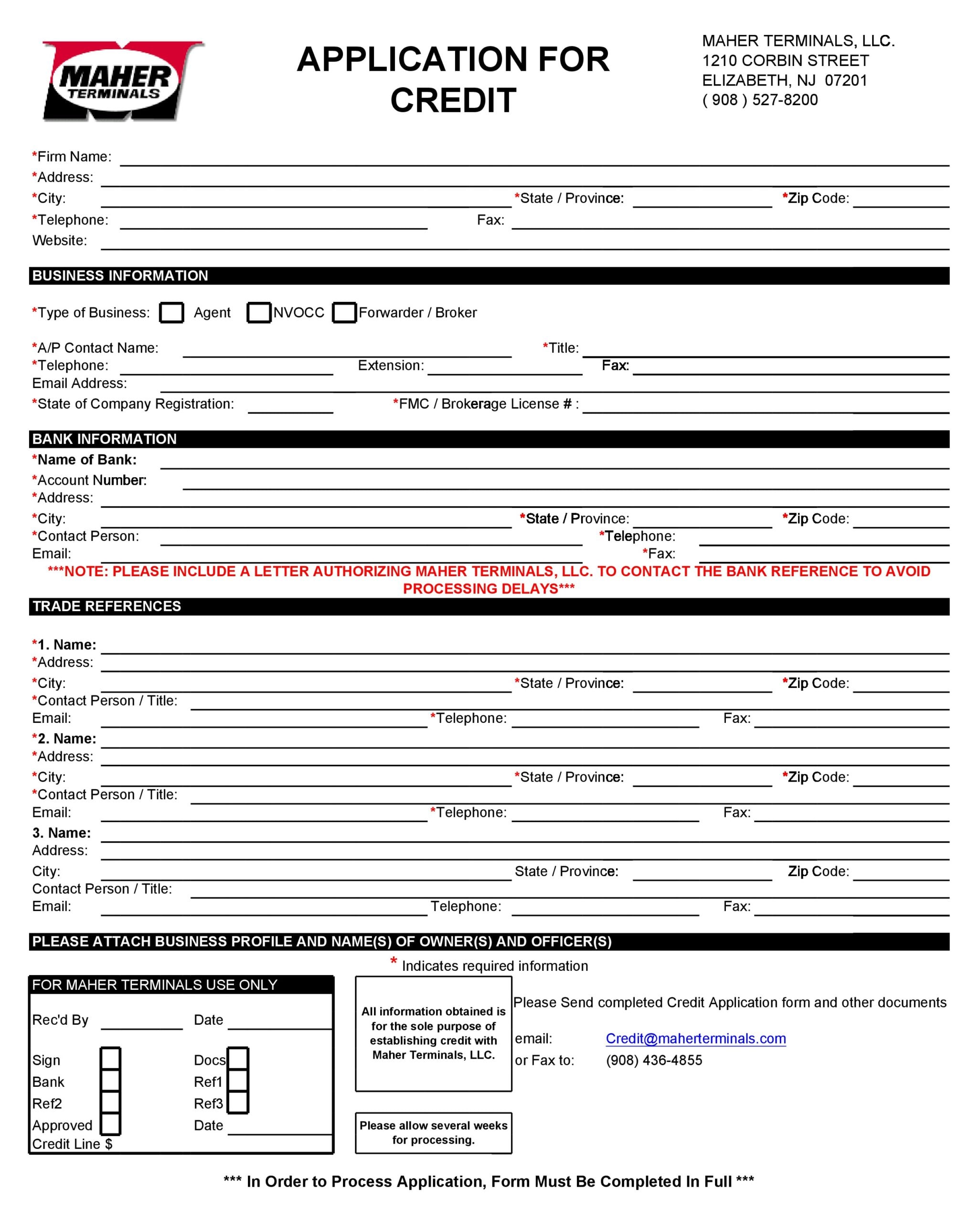

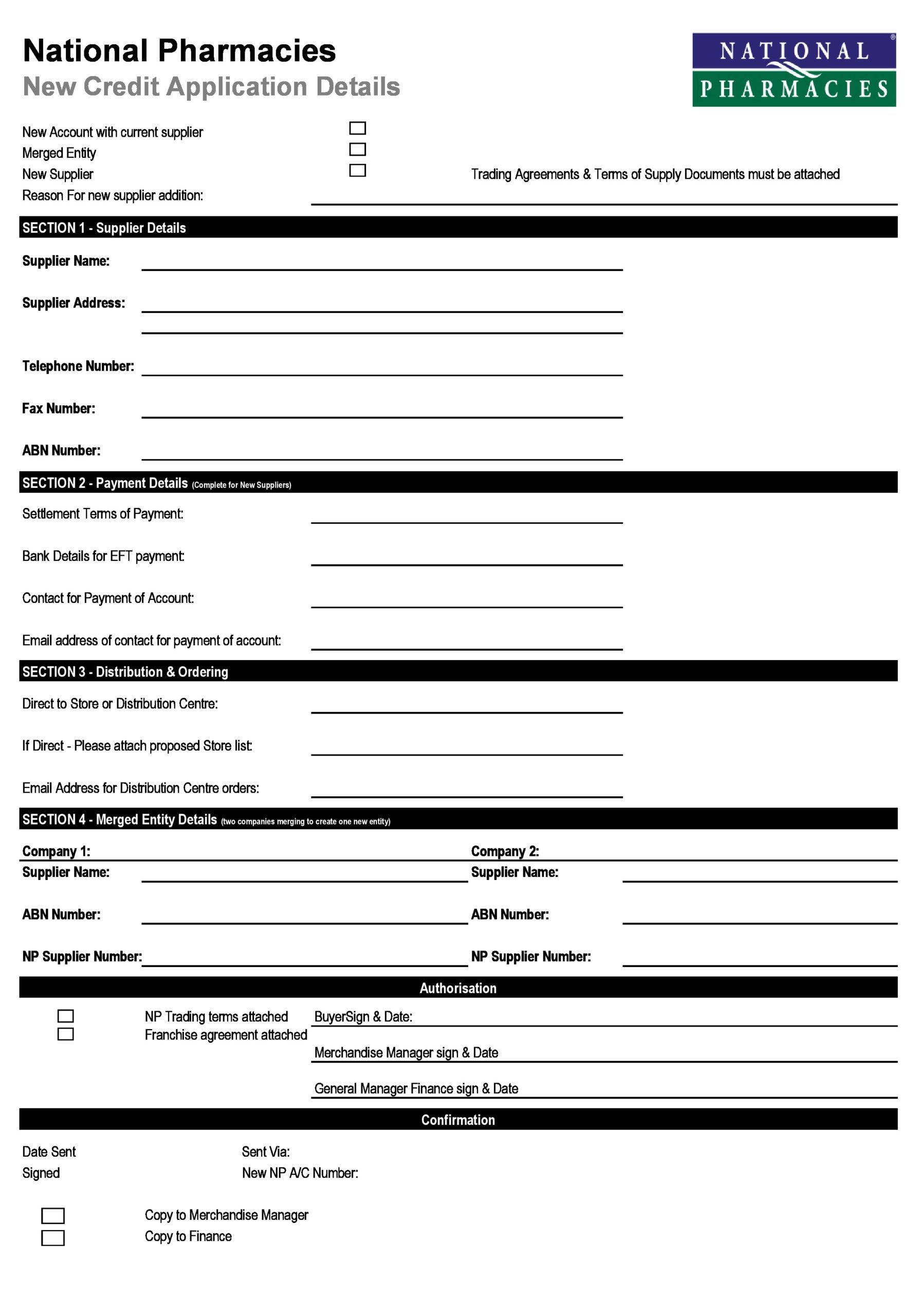

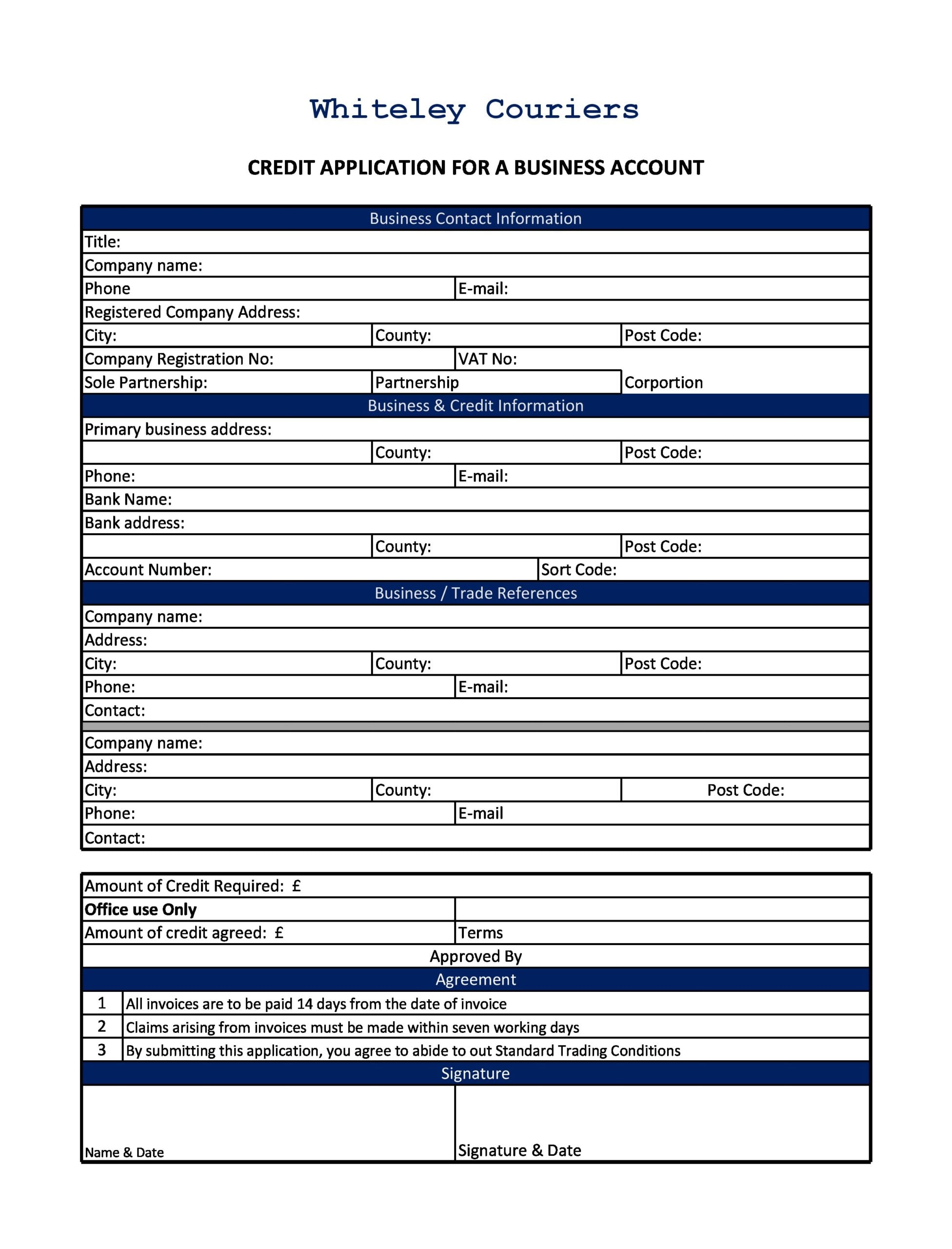

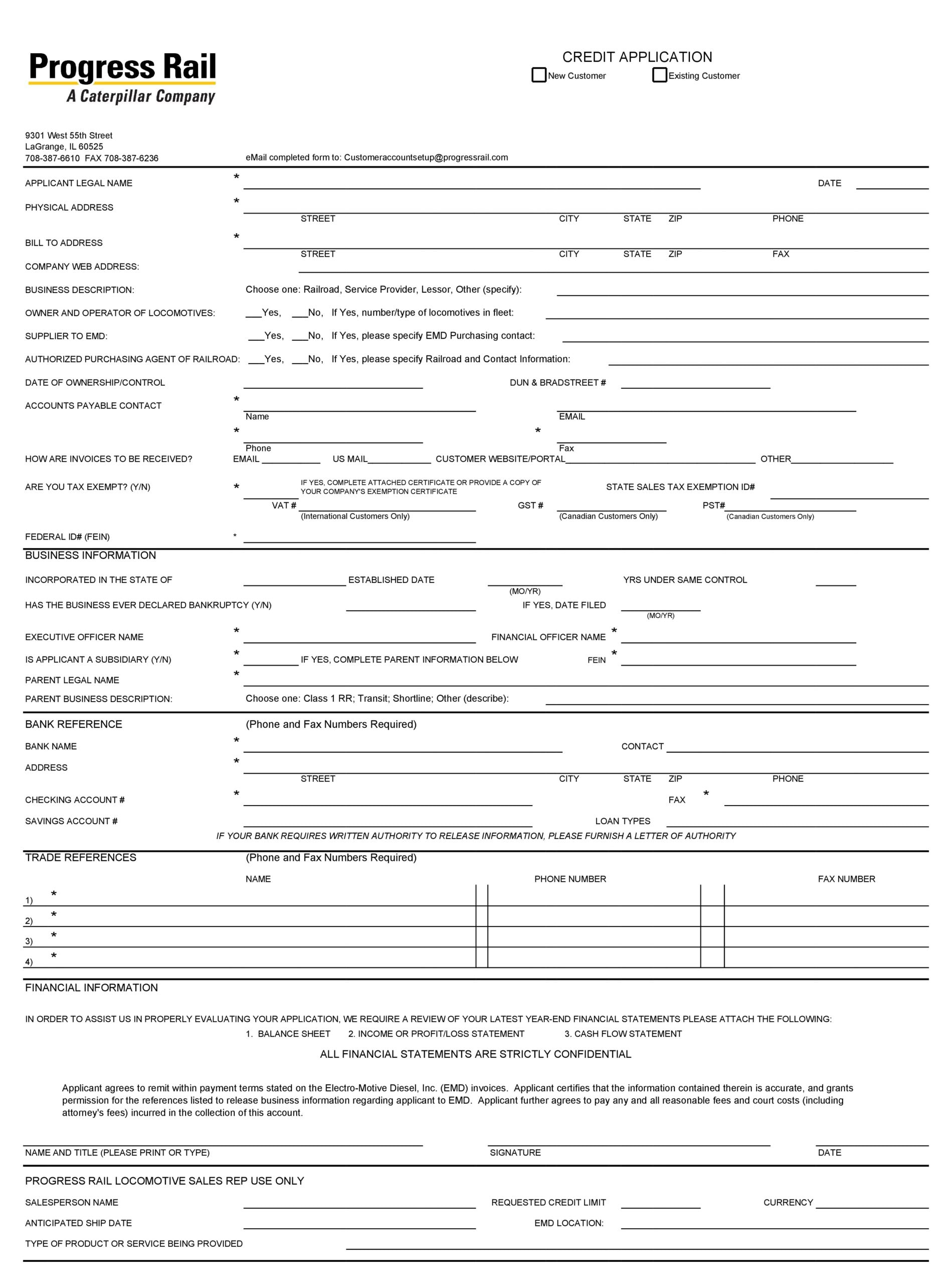

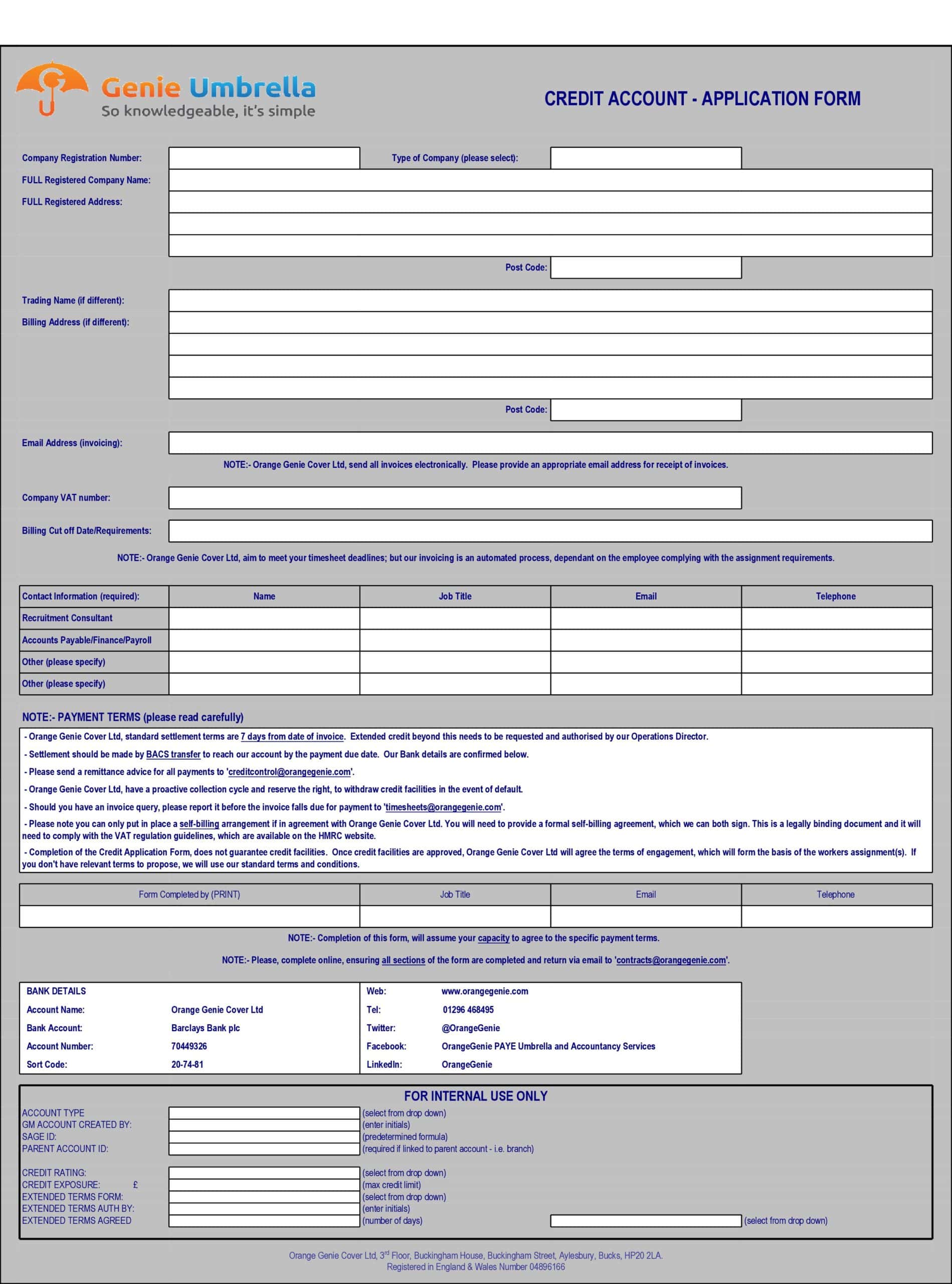

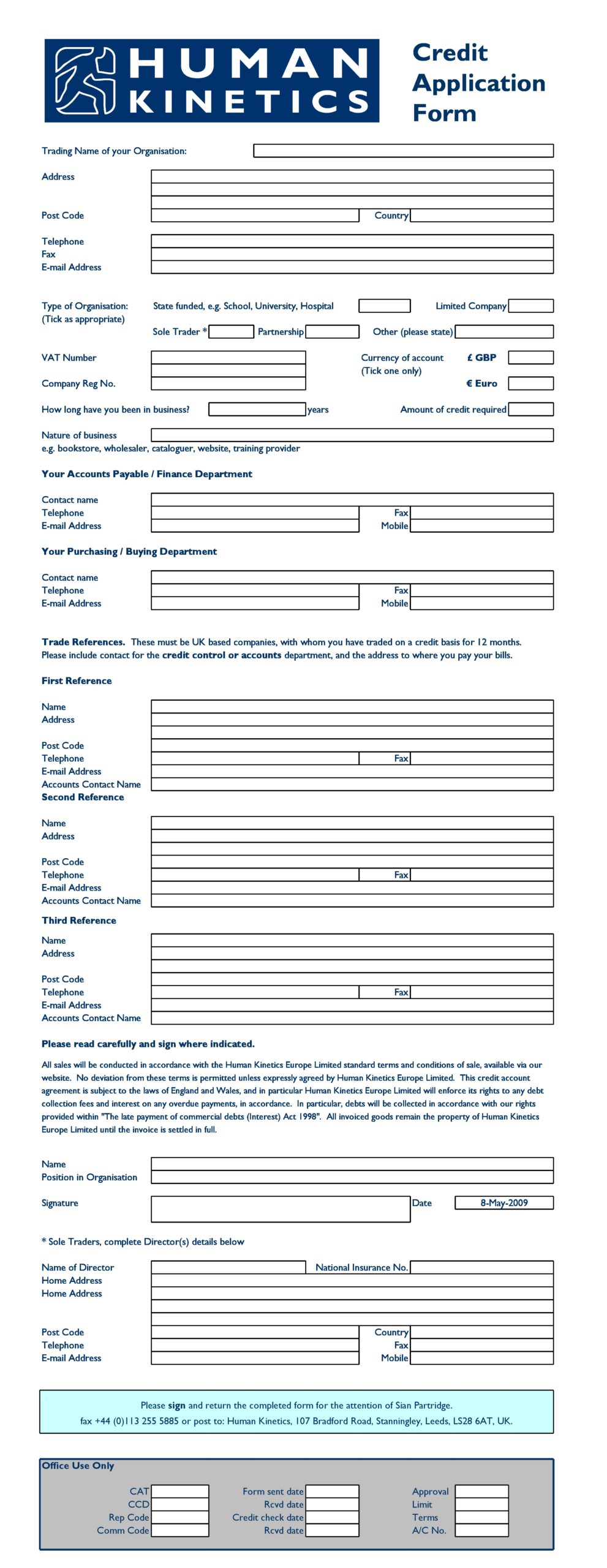

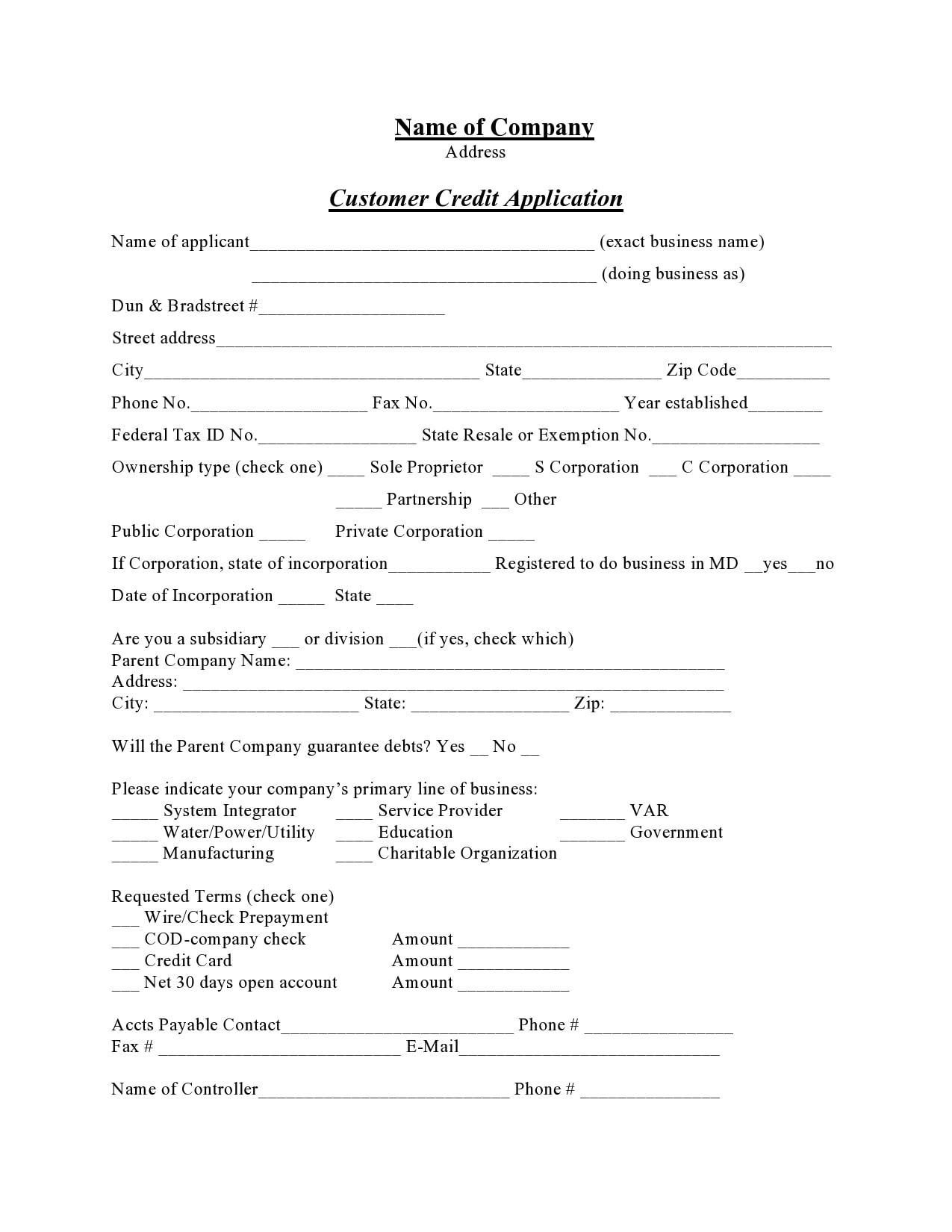

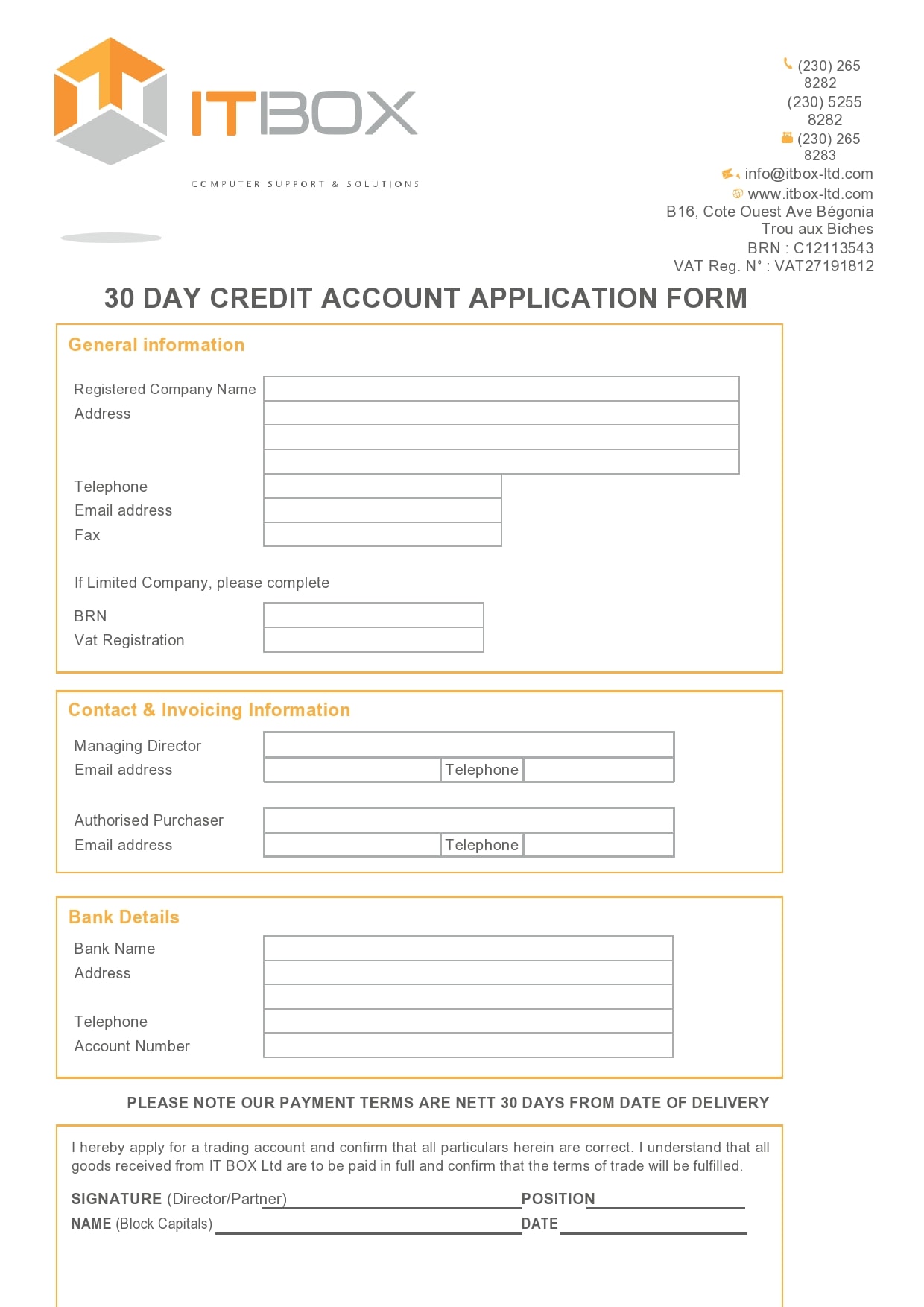

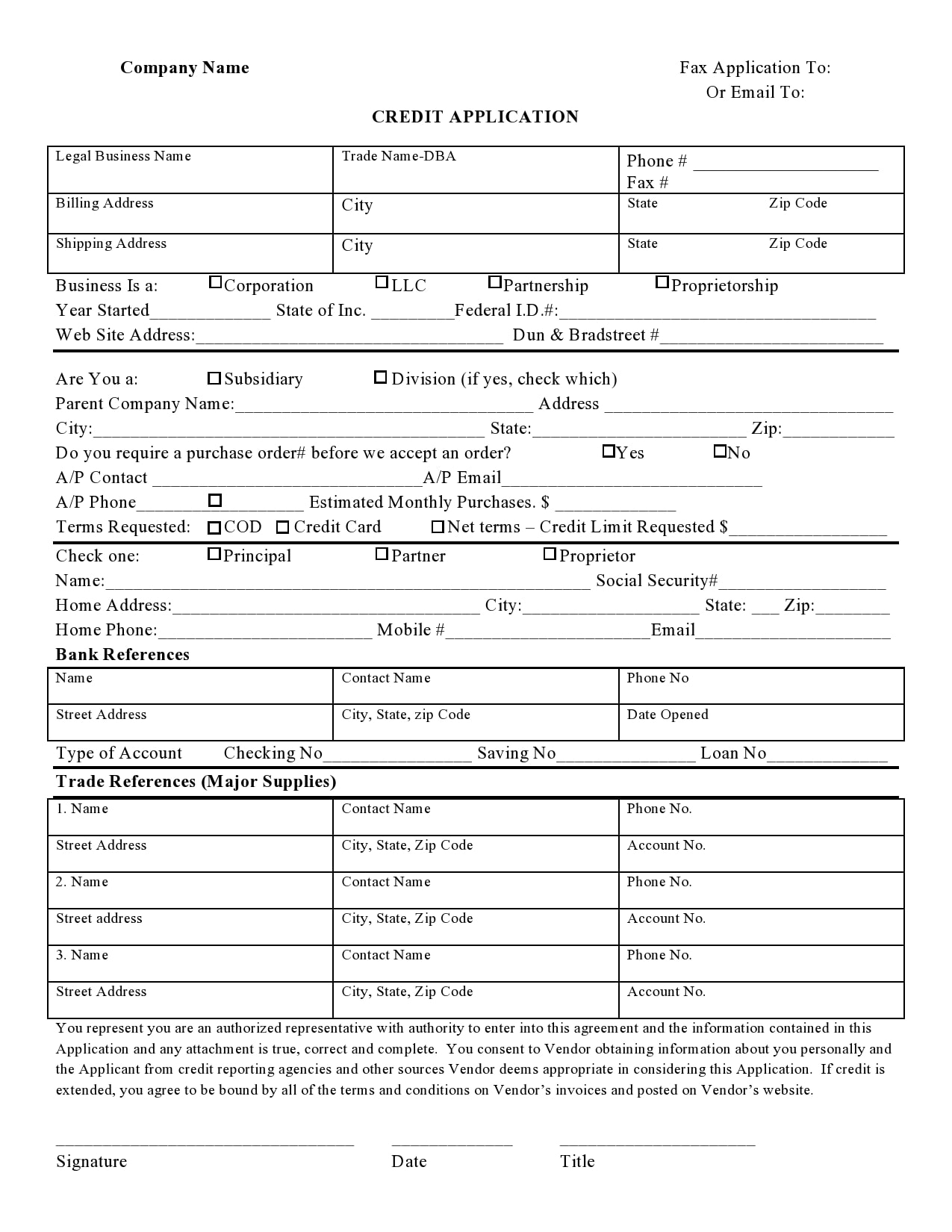

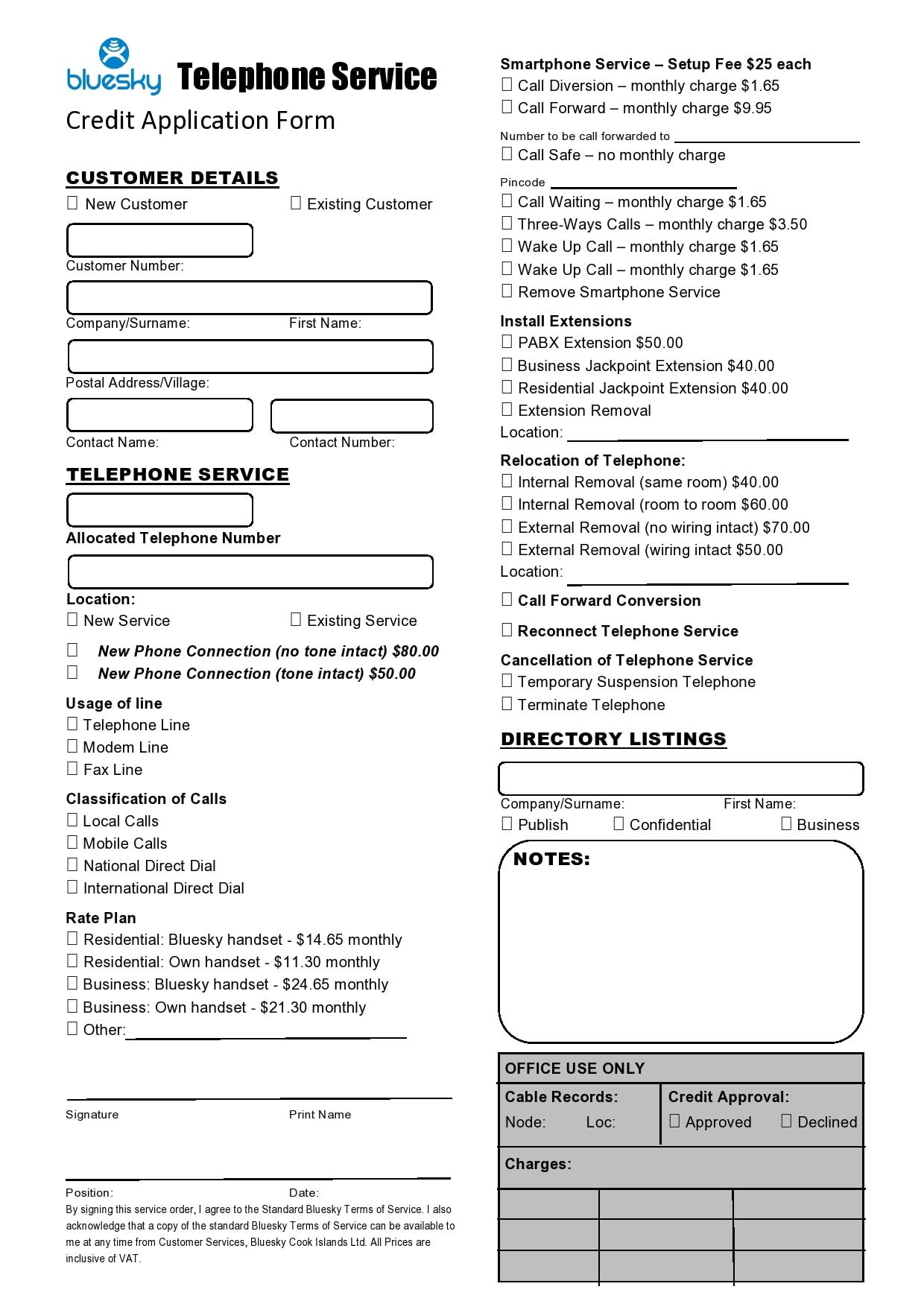

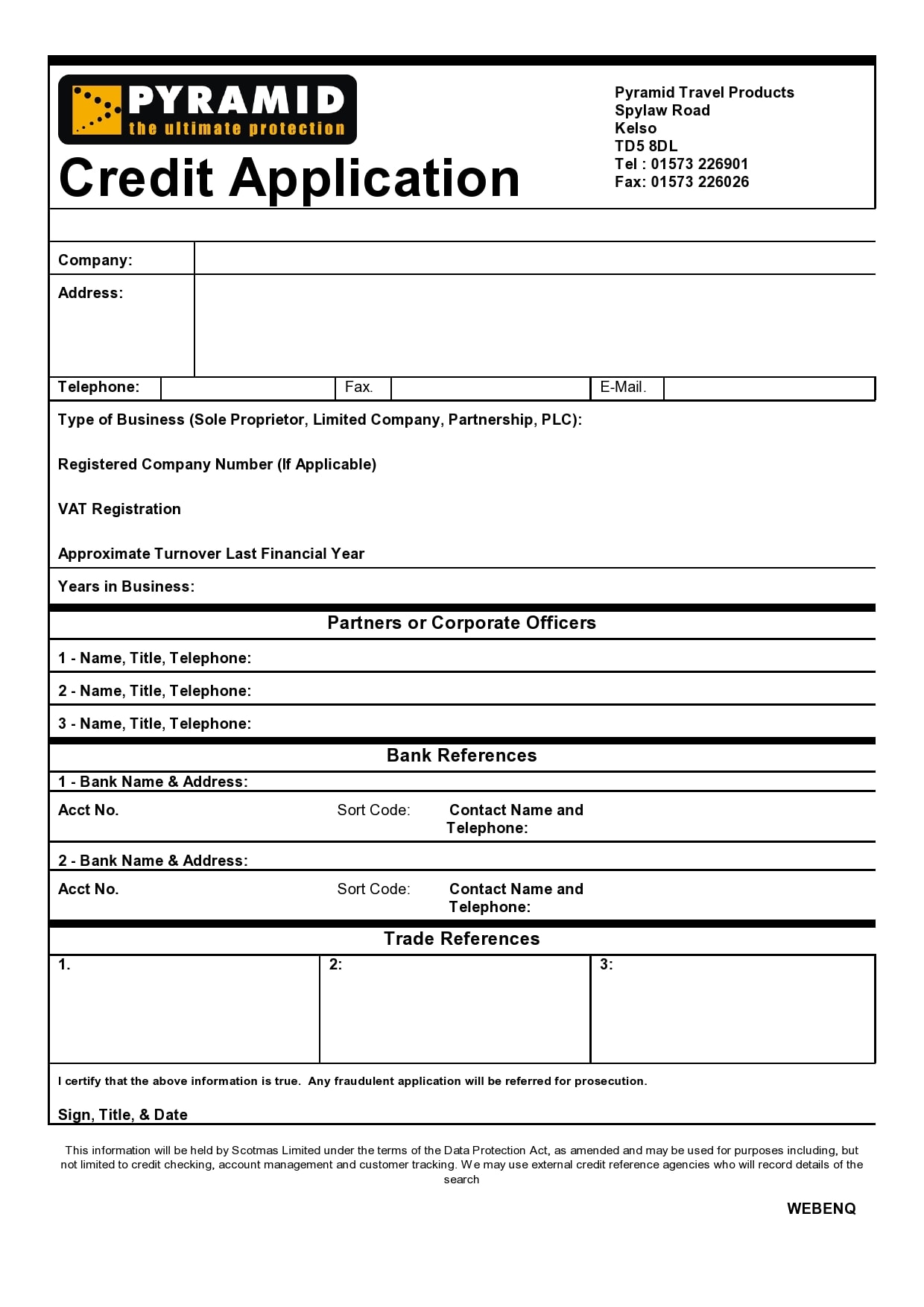

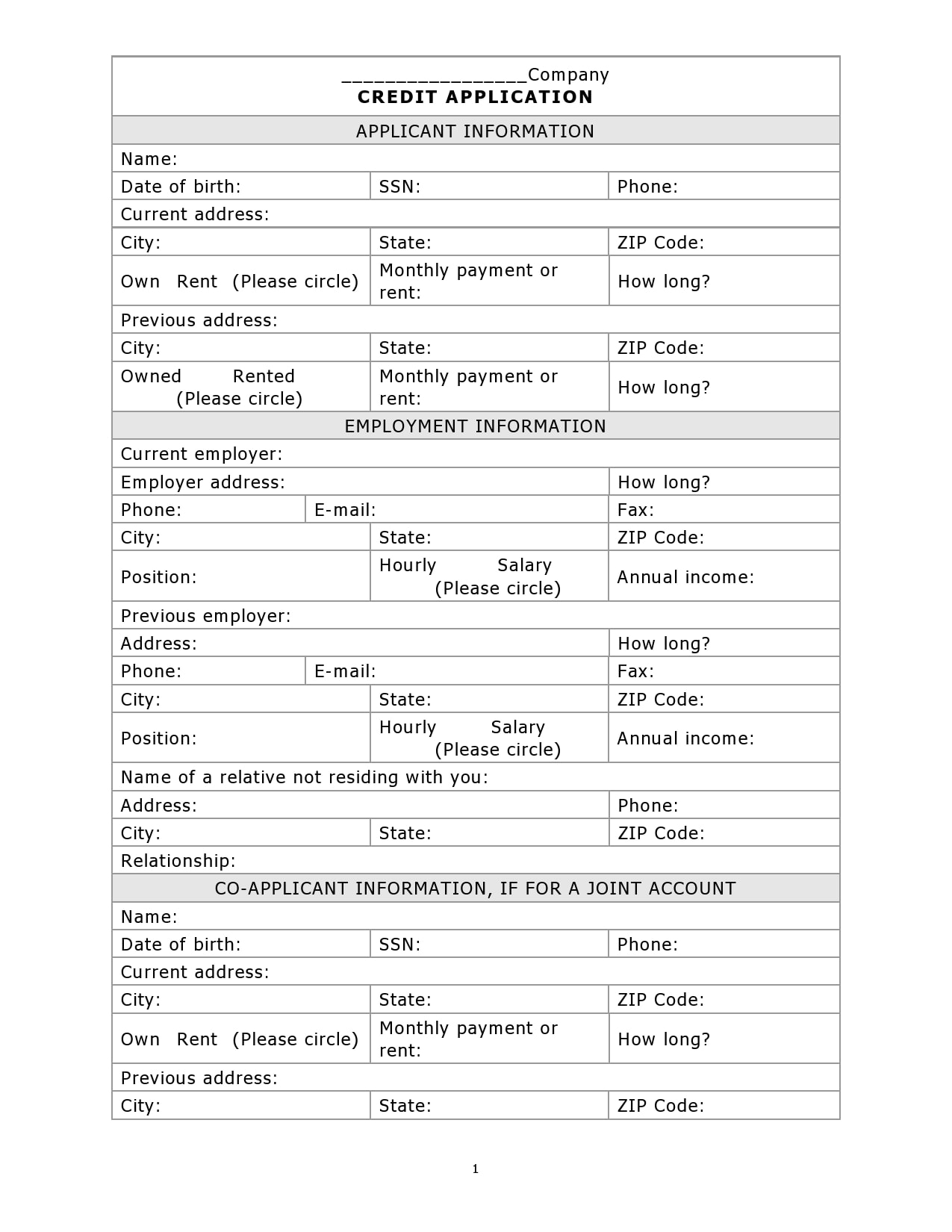

Credit Application Templates

What is a credit application?

Simply put, a credit application template is a simple request for a credit extension. You can accomplish this either verbally or in the form of writing, typically through a credit application form. Whichever, the application should legally contain the relevant information related to the credit cost to the borrower.

Because of the advancement in electronic technology, credit applications now have faster processes. The new automated financial systems has taken over the credit market. The system permits lenders to suggest to their customers different kinds of credit applications.

The Federal Reserve Board’s “Regulation Z,” is a legislation designed to protect consumers against misleading lending practices. It also governs the disclosed information provided in generic credit applications and provides consistency for any type of loans.

Both businesses and consumers seeking credit can now choose from different providers. Aside from the usual traditional credit cards and lenders, those who wish to borrow money can choose from several companies and institutions which offer several types of loans as per your particular requirement.

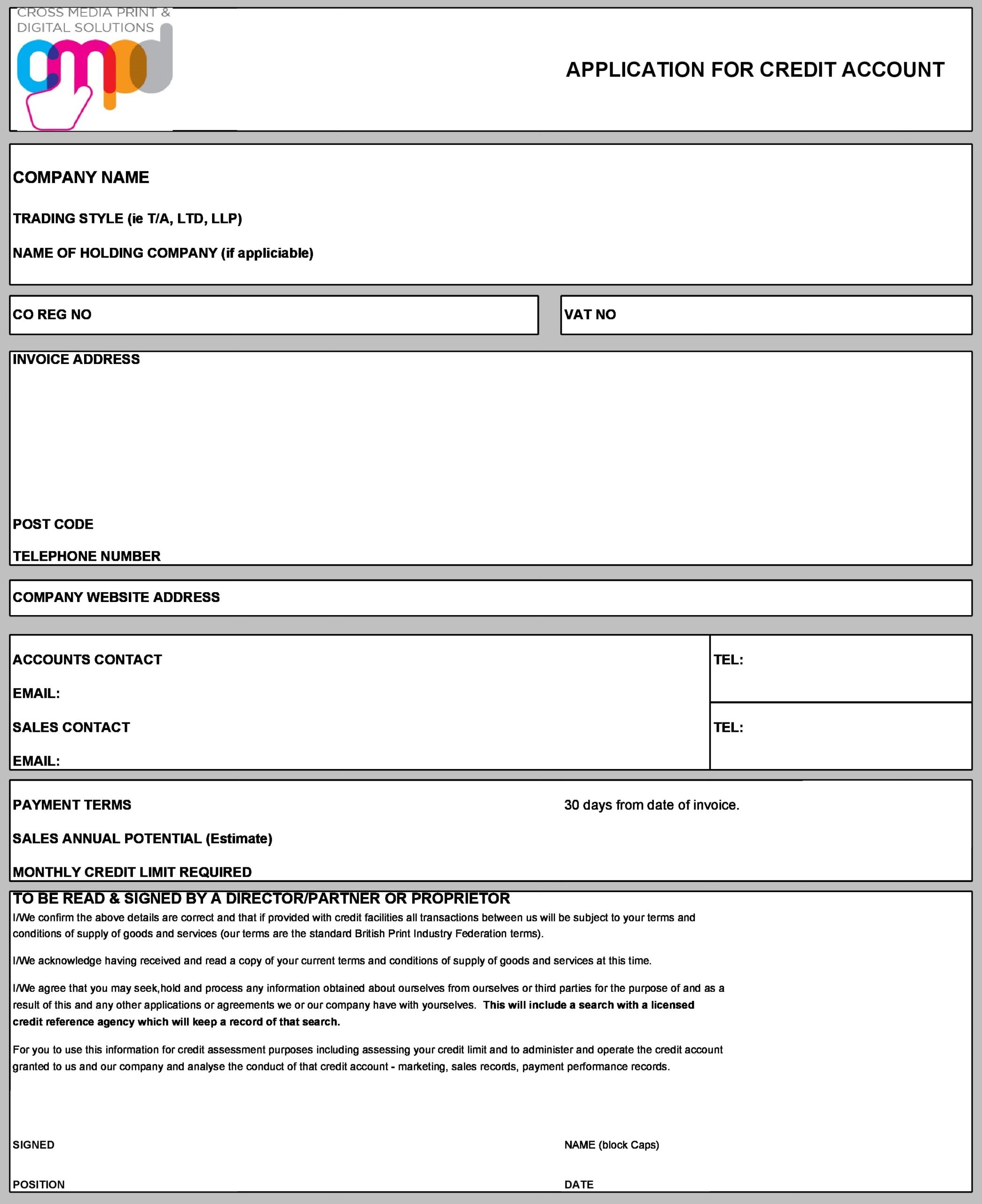

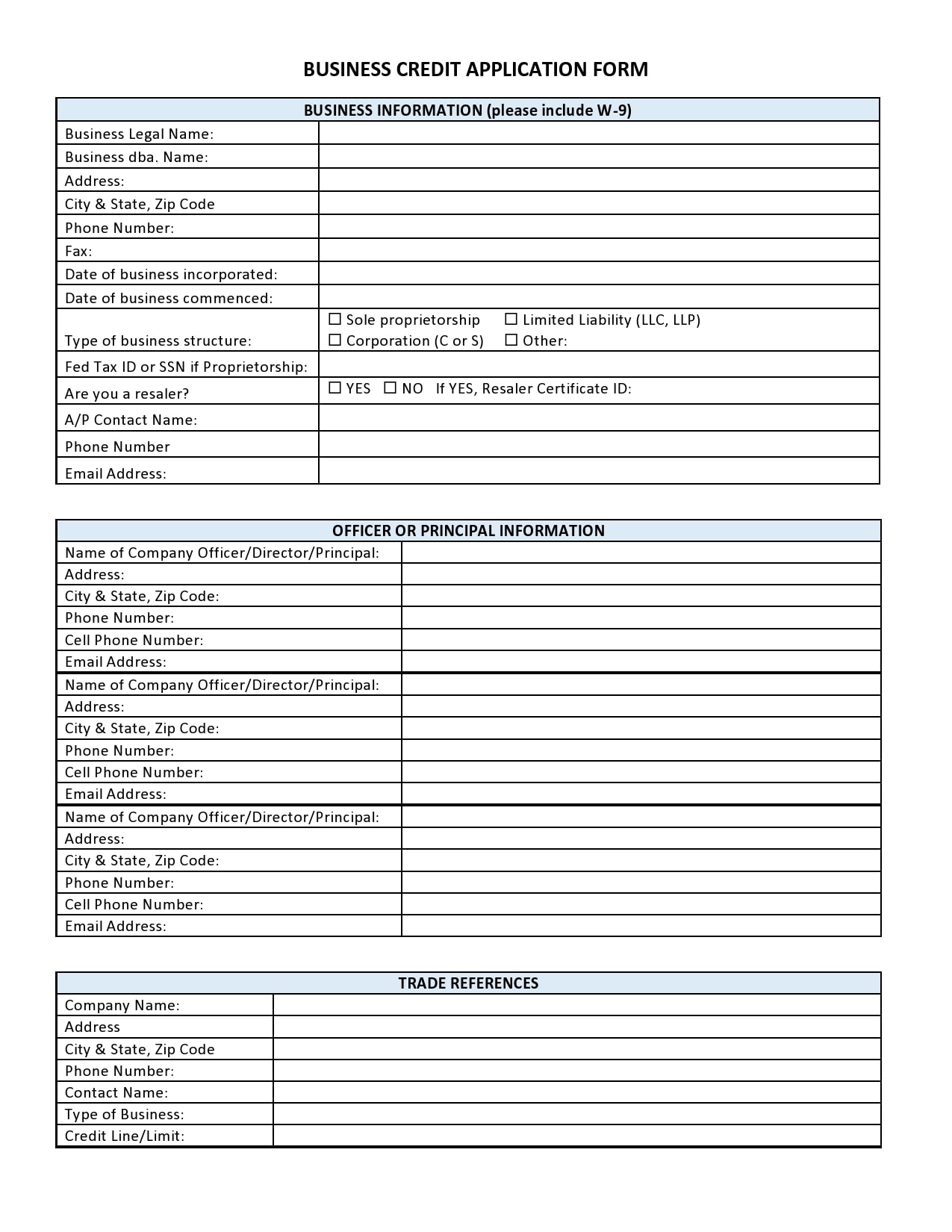

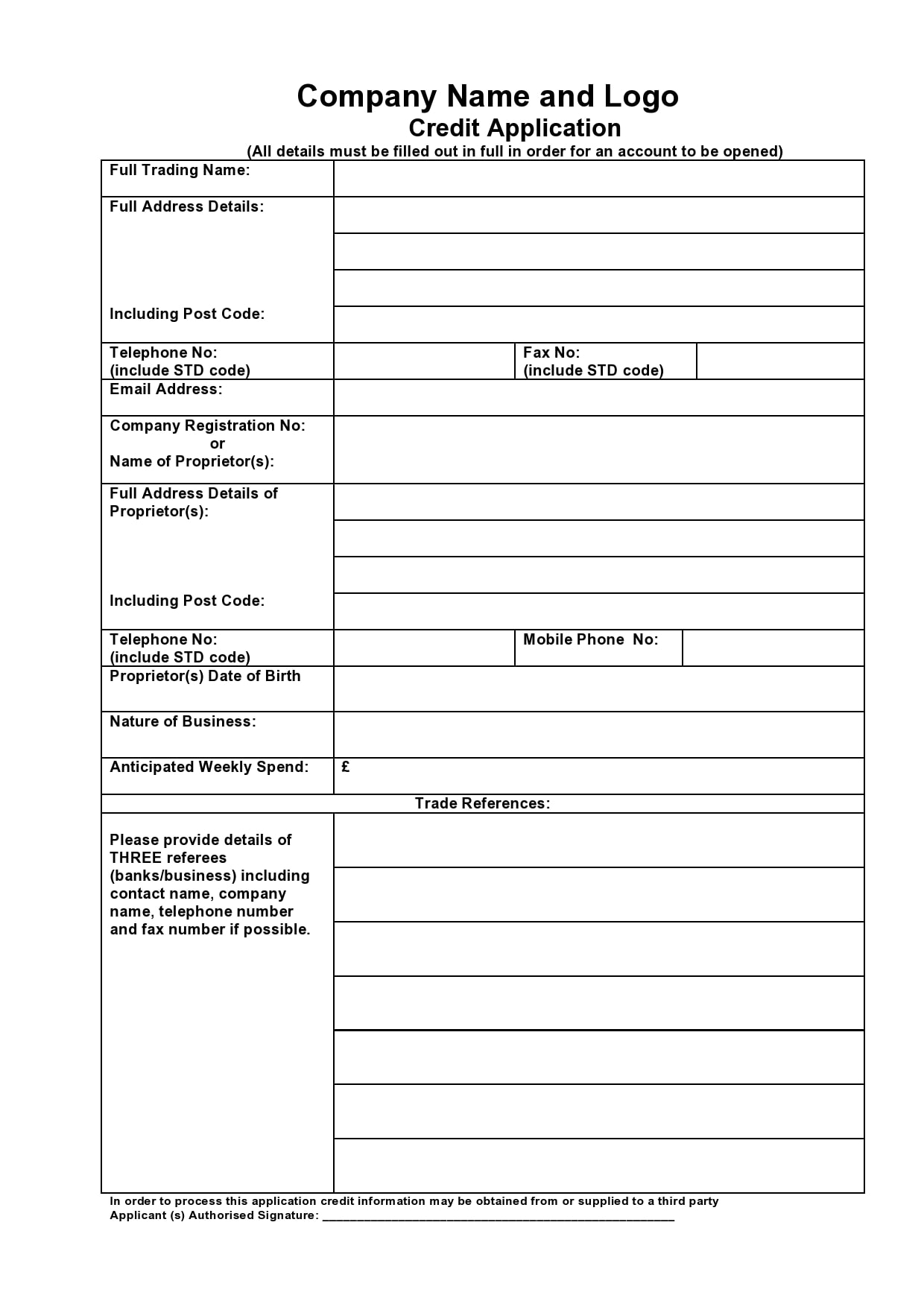

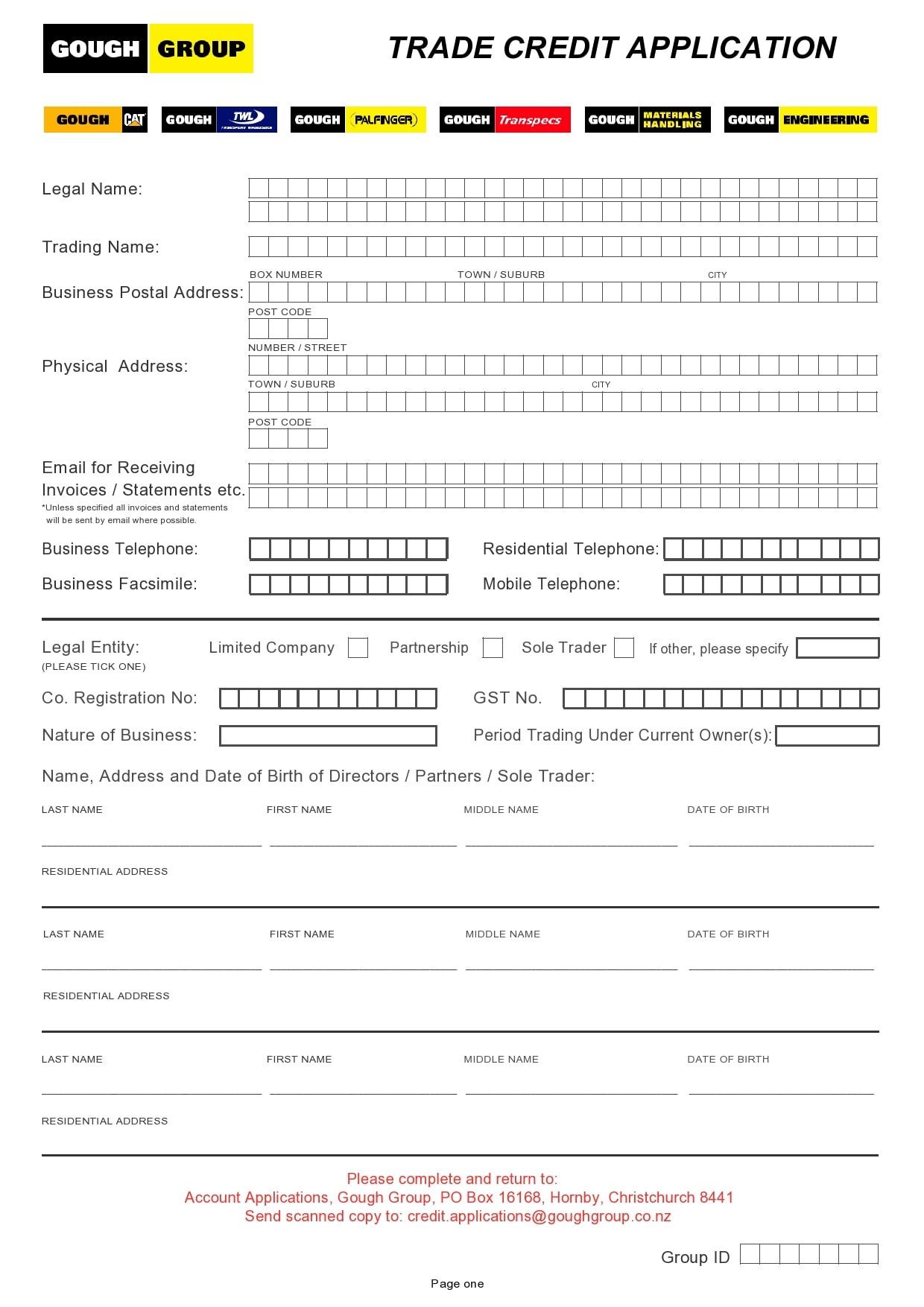

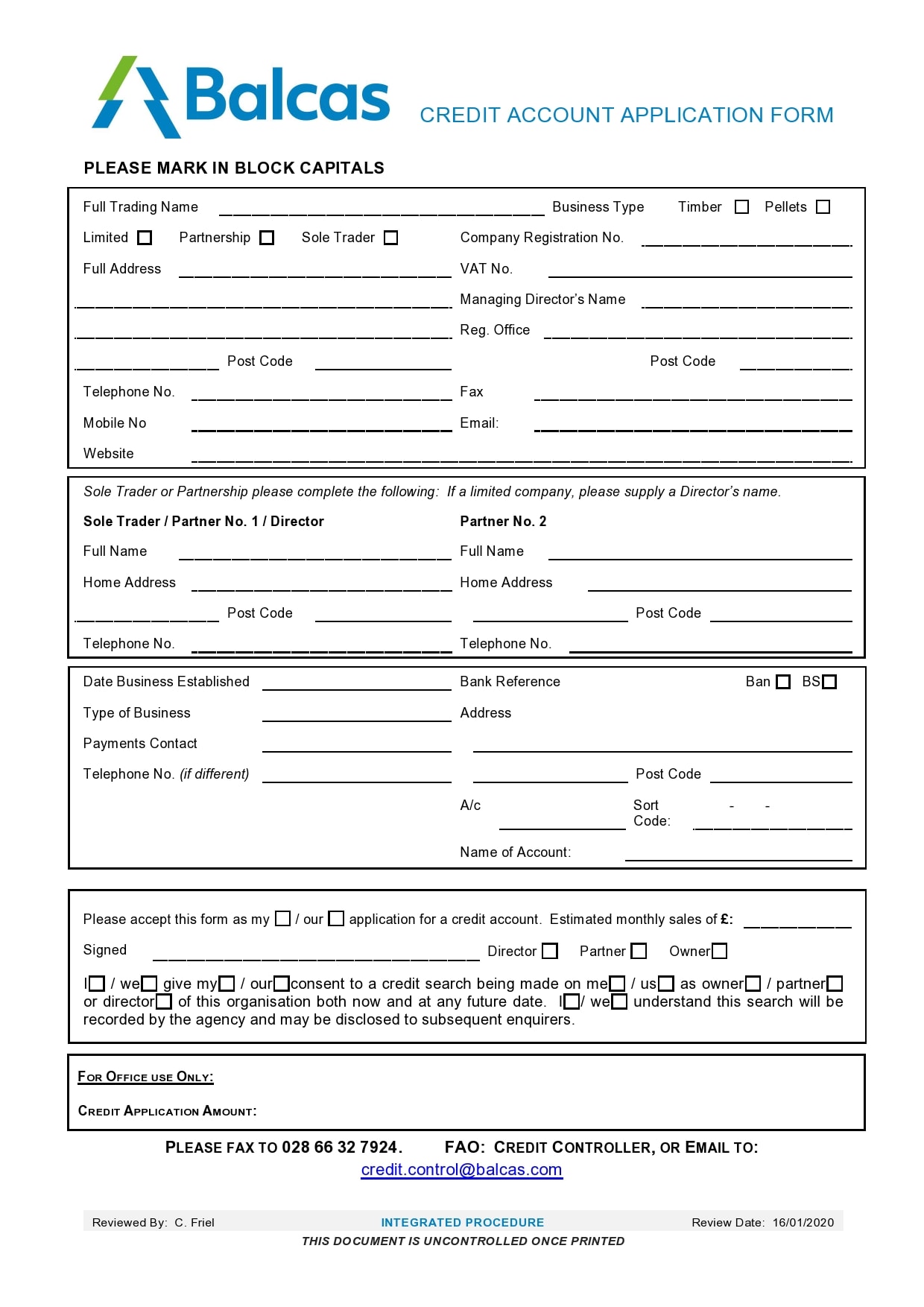

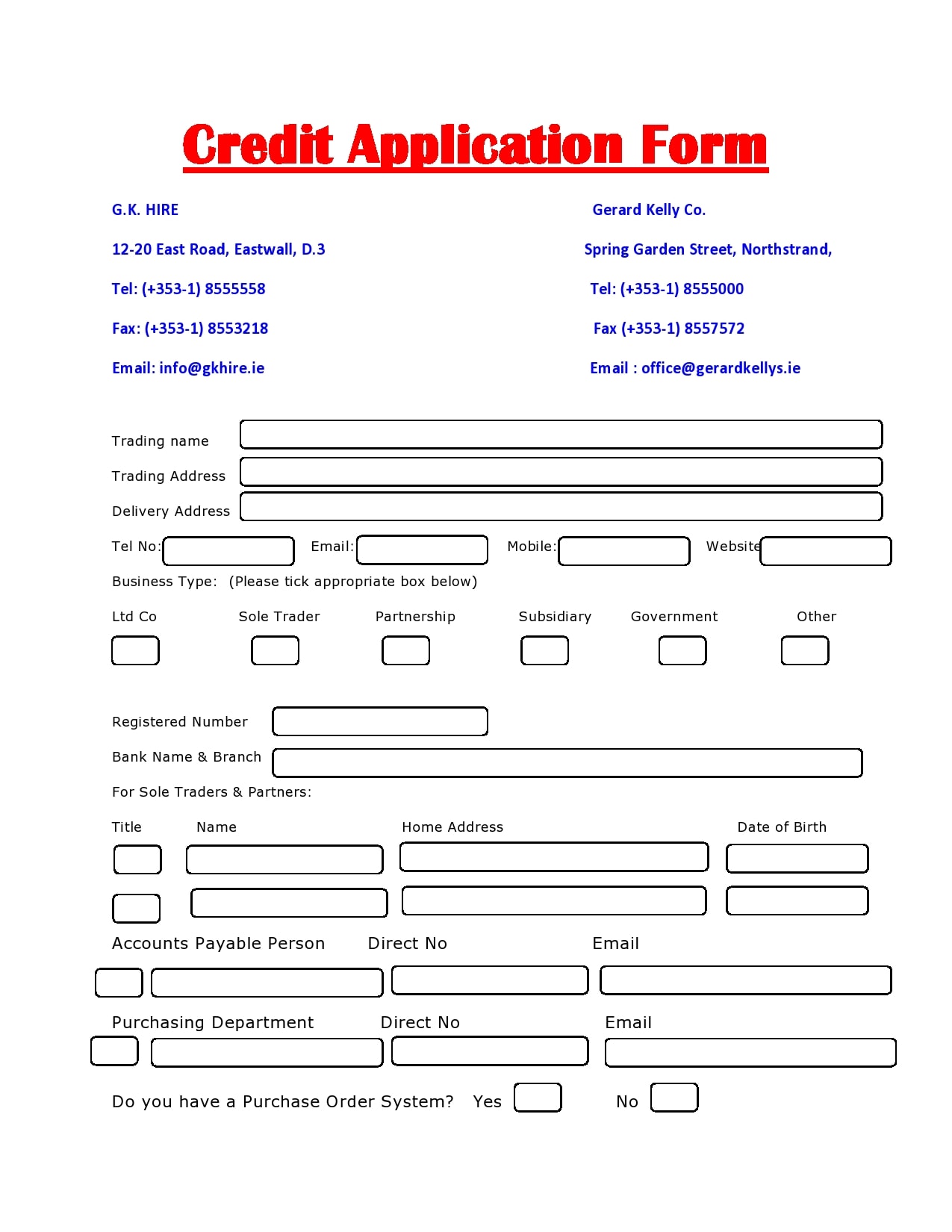

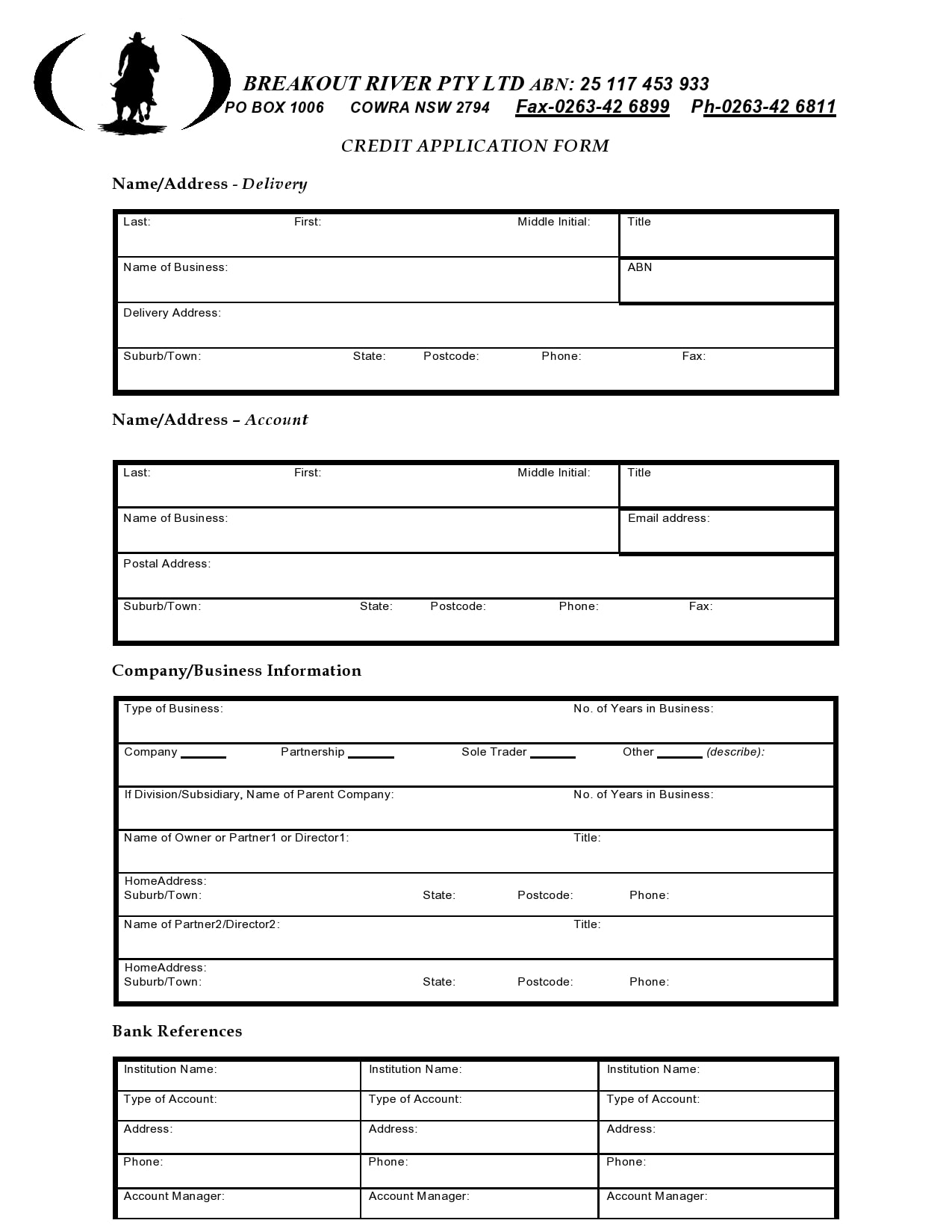

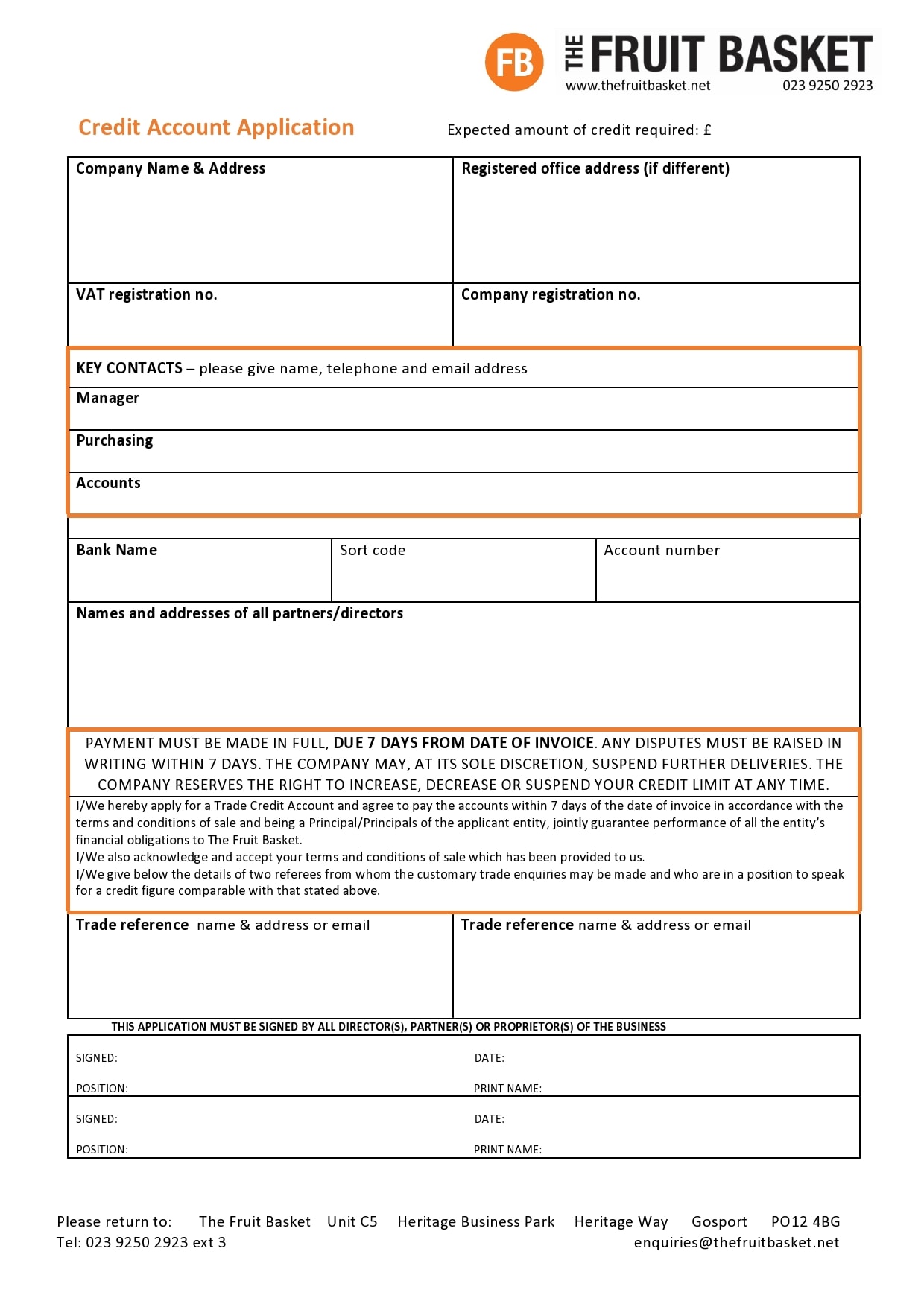

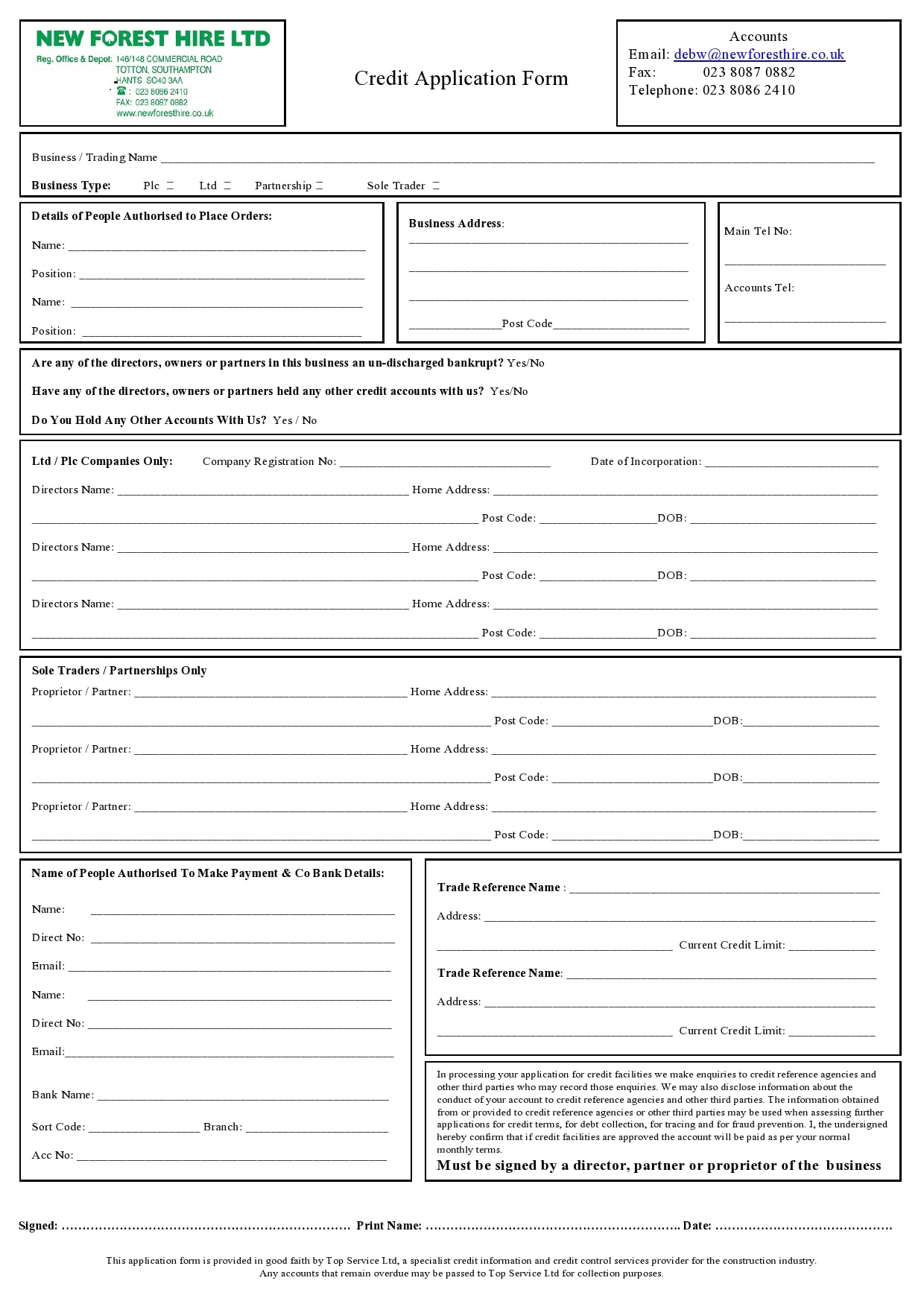

Credit Application Forms

Information to include in your credit application

When you have secured a business credit application template, it doesn’t really guarantee payment for the loan, but it’s one of the more important documents that you may get in assisting a credit decision along with the collectability of collection fees and past-due accounts receivable.

An effective credit application template helps you get to the point you want to be at. The credit application form is the initial step in collecting information regarding a prospective customer. Knowing them makes it better and easier for you to make a sound decision and through the gathered information, you can determine the amount of credit to extend.

Of course, it’s important to remember that not all of the information in the application form is completely true or correct. It will be up to you, through due conscientiousness, to verify the validity of such provided information on the generic credit application before granting credit.

Because of this, it’s essential that the company’s sales department should make certain that every client fills out the business credit application template and signs it before delivering any products or services.

A standard application usually requires this information from the applicants:

- Name of the applicant

- Complete address

- Name of the parent company and its complete address

- All contact details

- Entity type

- Names of the principals, directors or officers

- Trade references and bank references

- DUNS number and Tax ID

- Financial statements

- Requested credit limit

- The agreement of the applicant to the payment terms

- The agreement of the applicant to pay interest on any past-due amounts

- The agreement of the applicant to pay for collection and legal costs

- The personal guarantee of the applicant with spouses

- An authorization statement to pull a personal credit report

- The right to verification of data on the application

- The signature of an officer or an authorized person

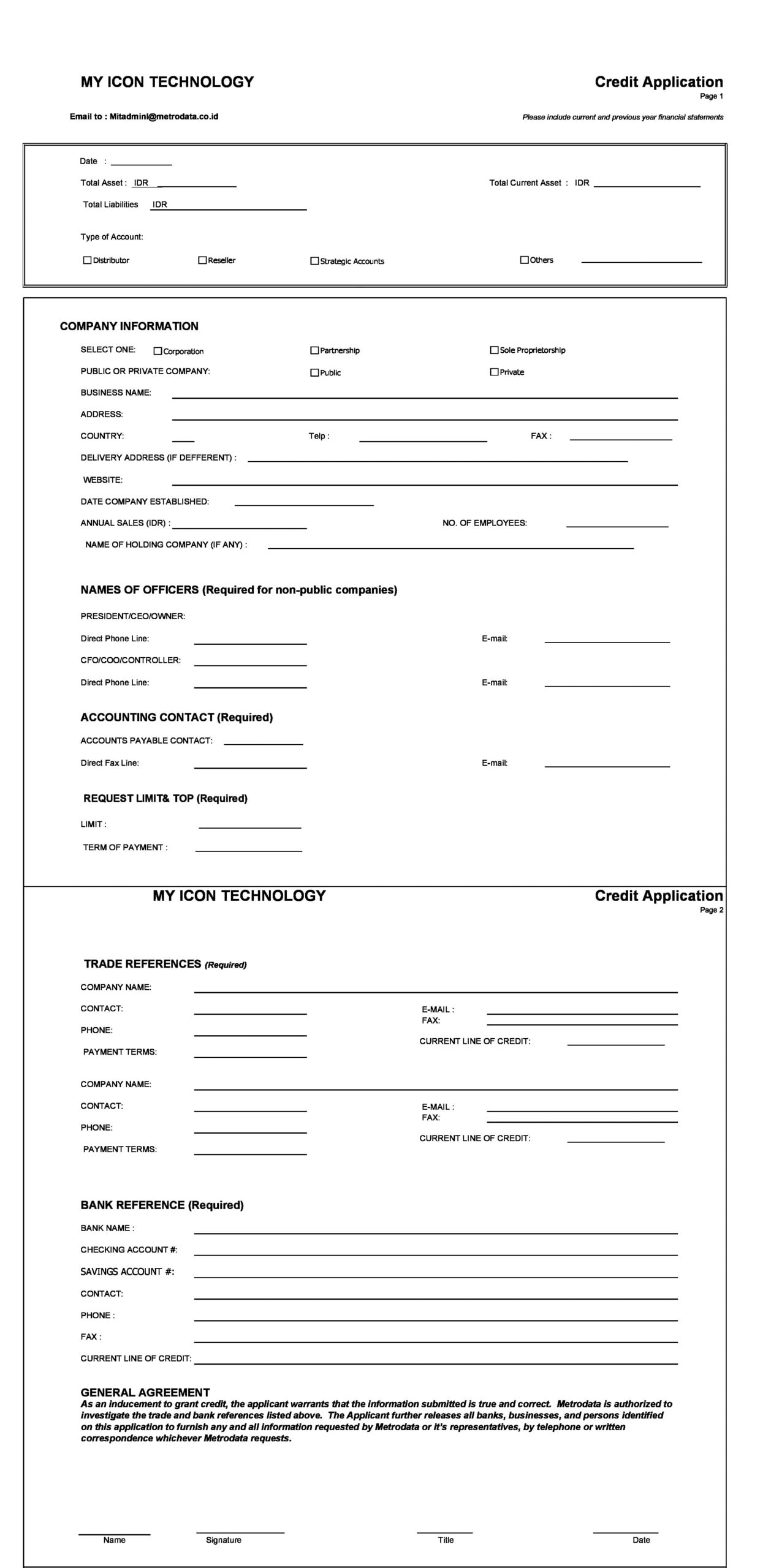

Important terms for your credit application

Both parties must keep in mind that a credit application template is already considered an official, legally-binding document once the applicant signs it. As an applicant, before you sign the credit application form, you should understand the terms written on it:

- Arbitration

The document specifies that both parties should agree to arbitration should there be any disputes regarding payments. Having this eliminates the costly approach of litigation. Incorporate in the arbitration clause the steps to follow so there would be no delays even with later negotiations. - Binding signature

An applicant could make a claim saying that the authorized person who signs the application doesn’t really have the authority. However, a clause may state that the signatory possesses the authority to agree with the terms and conditions in the document. - Electronic payment

The applicant pays the lending company by allowing the company to automatically debit the customer’s bank account. This happens through an ACH debit transaction after a certain time period or on a specific date each month. - Fee reimbursement

If there’s a need for the company to hire a third party, like a collection agency or a lawyer to do the collection from an applicant, the latter agrees to shoulder these fees. Although there’s a slim chance that these fees will be actually collected, it still is worthwhile to include the clause to give the company some extra leverage. - Inspection

The applicant agrees to examine the goods upon delivery and issue complaints about any issues found but within a certain time period. After the allotted time expires, the customer forfeits to right to stick with his claim for the damaged product. Having this clause gives the customer fewer options for delaying the payments. - Legal venue

Both parties should agree that in case there’s a need to take legal action, the litigation of the case will get dealt within the company’s state of residency and not in the applicant’s state of residence. This helps reduce the travel expenses that the company may incur. - Personal guarantee

This means that the person who signs the generic credit application should agree to personally guarantee the debts the applicant owes. This particular clause draws the most frequent objections from applicants but it’s worth pursuing so you can establish legal claims for the company. - Returned check fees

Should the applicant issue a check for payment for which there aren’t enough funds, the company can charge the applicant the associated bank charges amount. This may result in a small reduction of expenses for the company though it can still be very useful in convincing customers or getting their attention. - Security interest

The company grants the applicant a security interest for goods sold. If the company follows up by filing the needed paperwork, they then have the right to the goods in question over the unsecured creditors claiming the goods too.

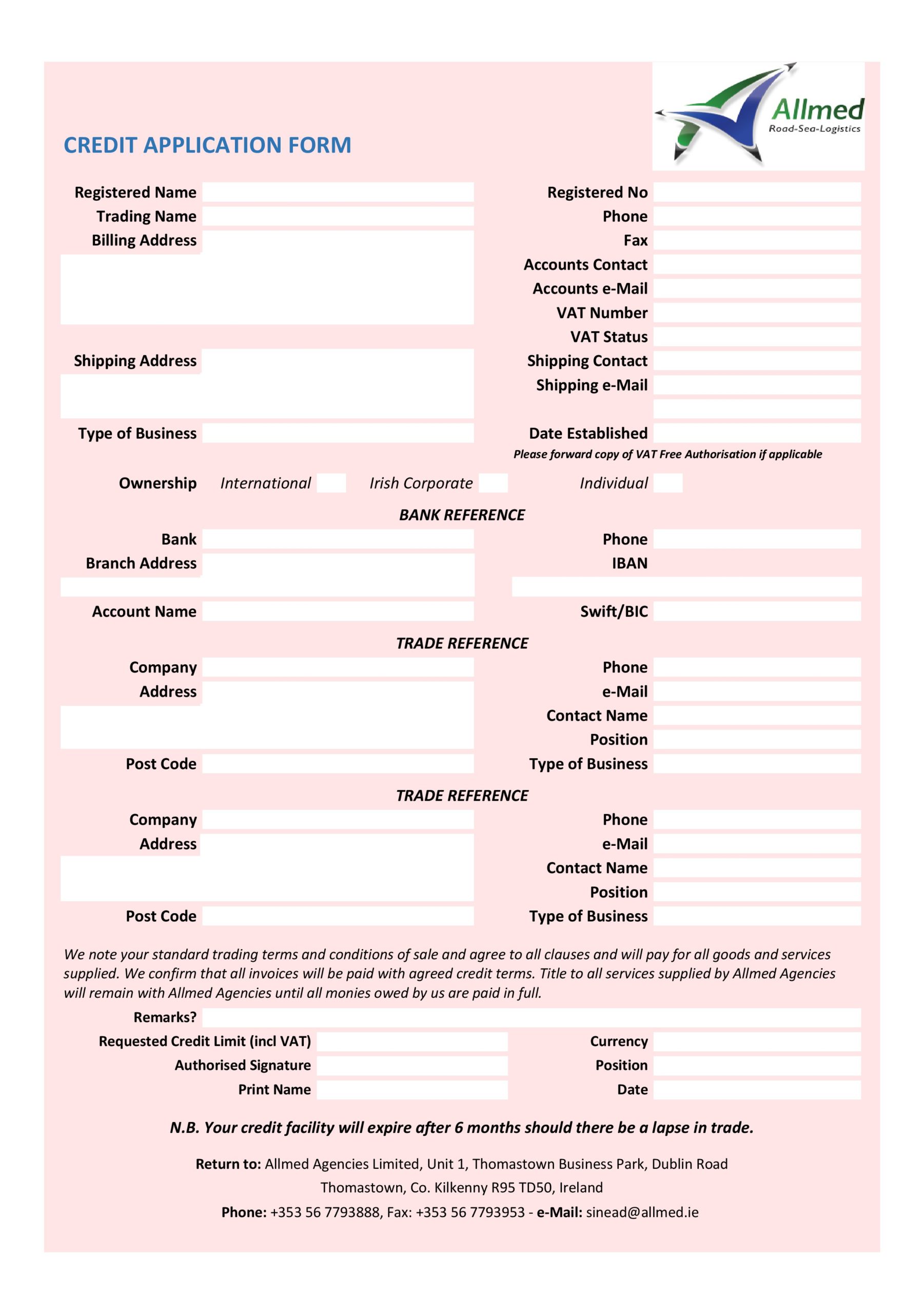

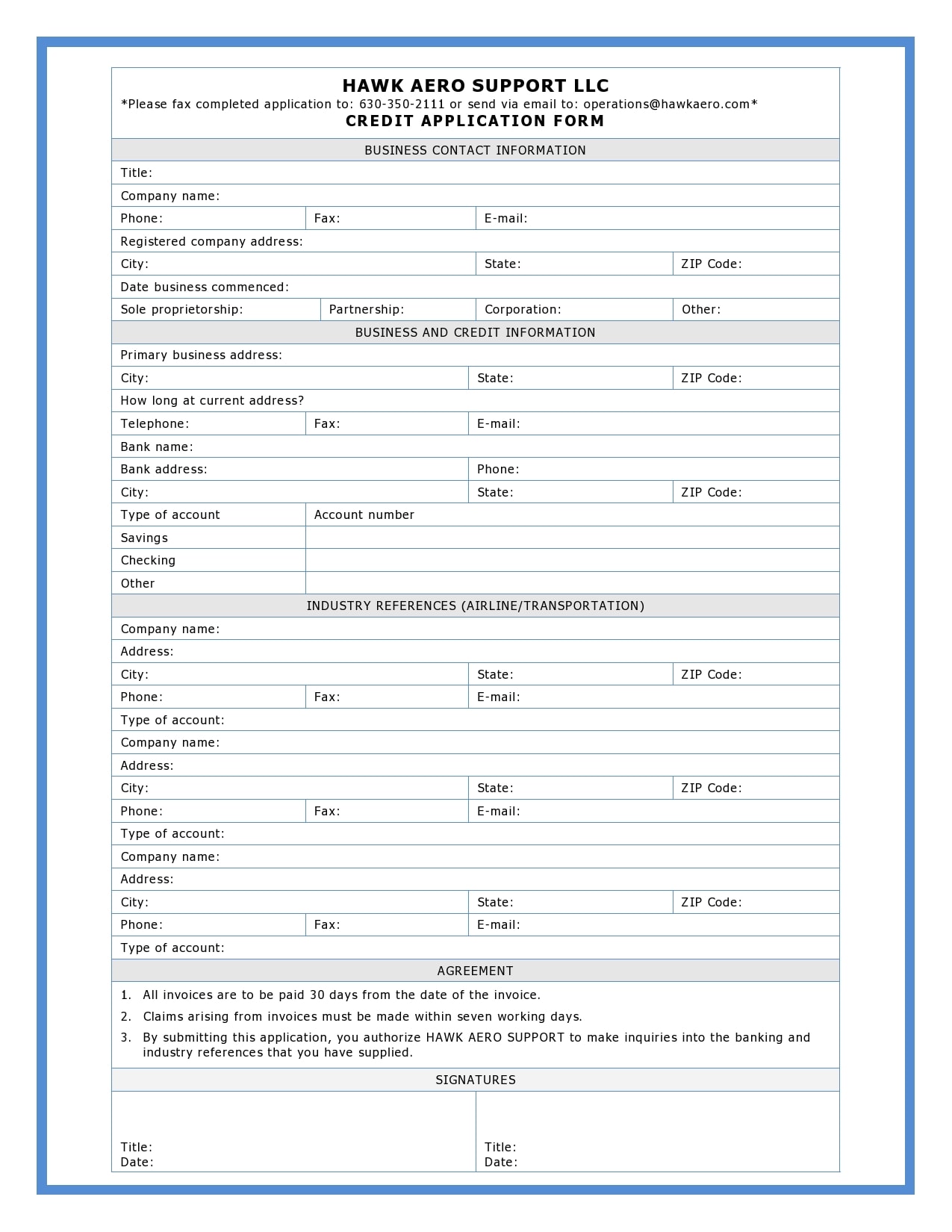

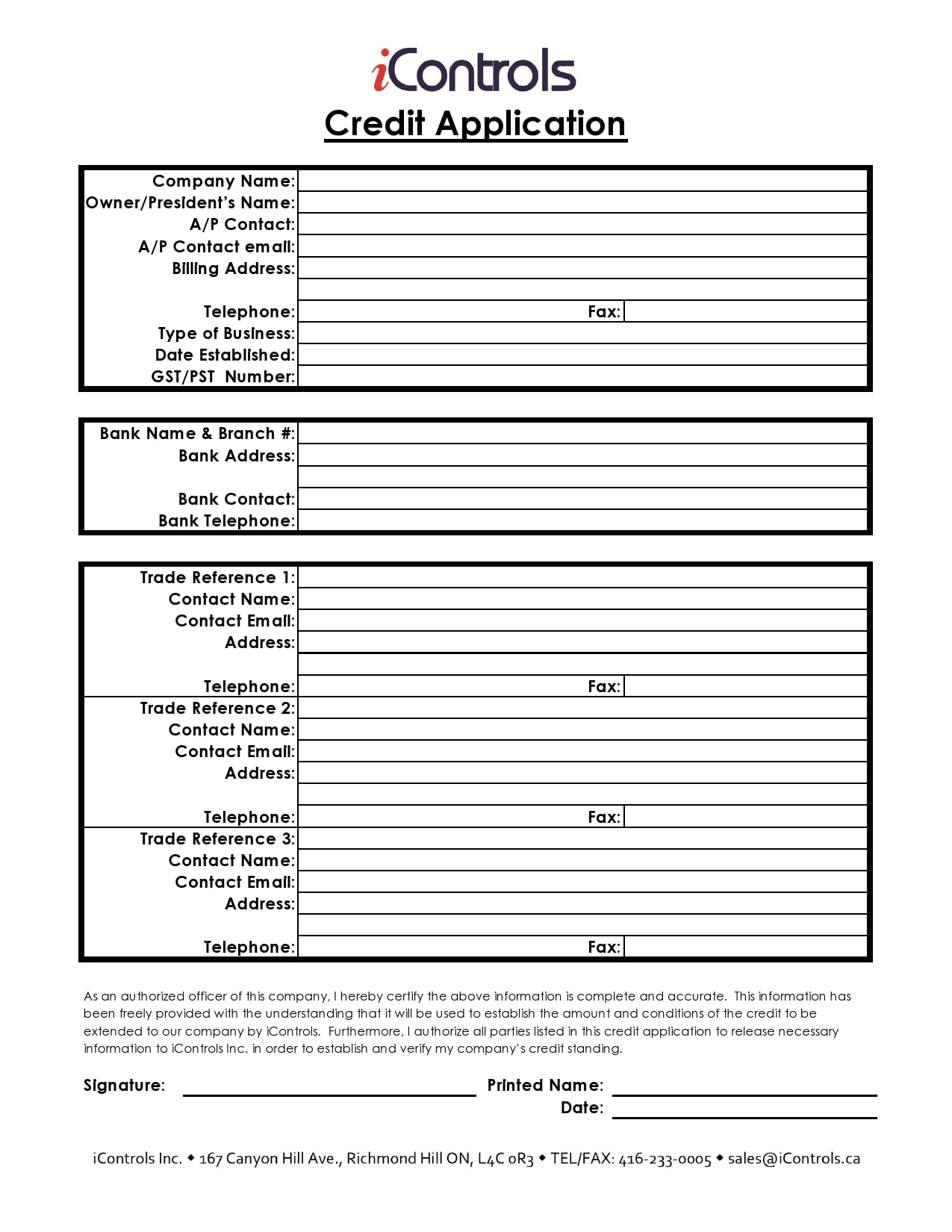

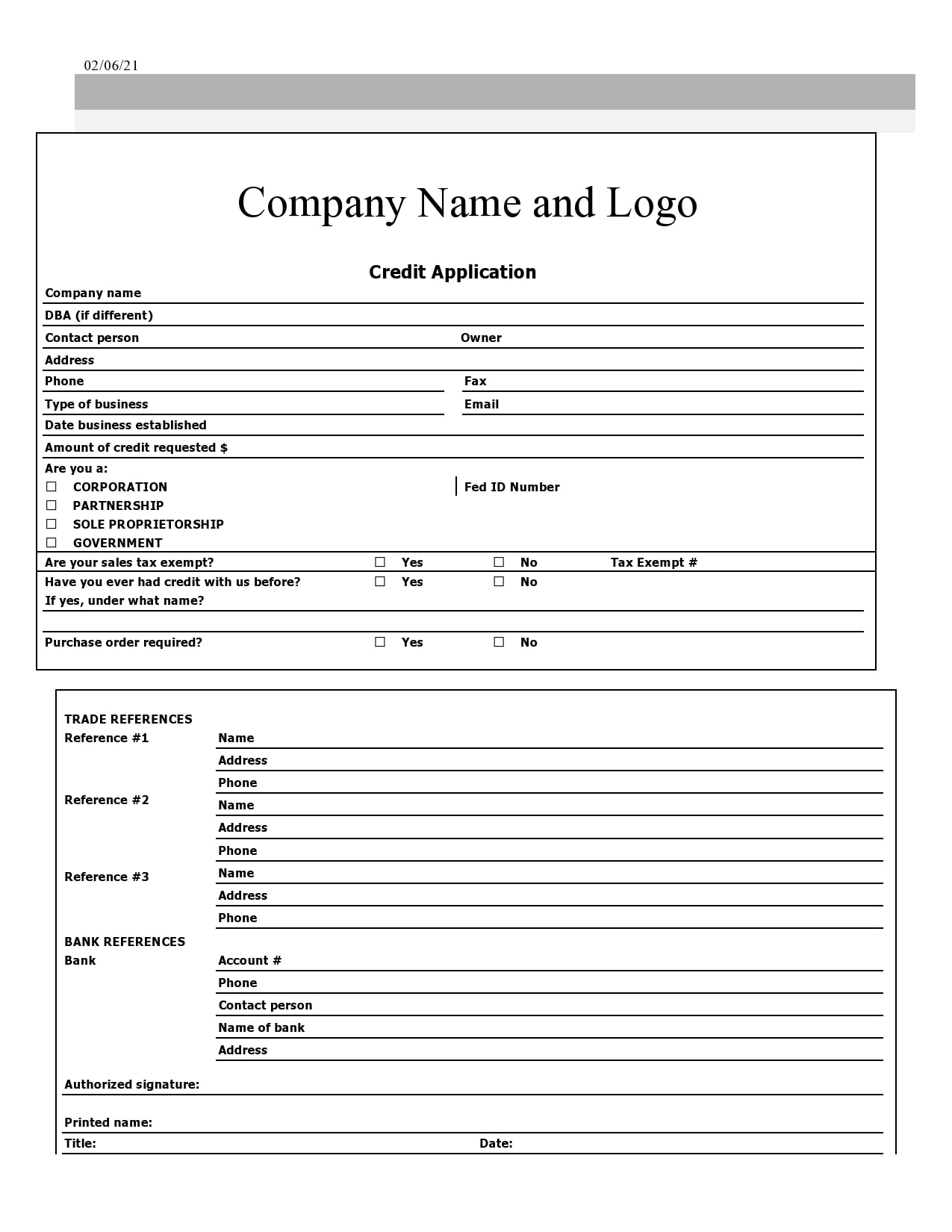

Business Credit Applications

What to consider when making a credit application template?

You can use the credit application template for two purposes. First, it’s a data collection tool and second, it’s a contract. For the latter, it defines the obligations and rights of the creditor and the customer. When writing on the business credit application template, remember that it’s a simple request for a credit extension.

This means that you need to write the required information to provide your company with an advantage should the business relationship fail. Here are the most essential things you should consider with regards to credit applications:

- The signees must be legally able to bind the company. An applicant cannot sign the application if he isn’t authorized to accept the terms and conditions of the credit application.

- Including a personal guarantee is possible as a part of the application. It’s highly recommended that when you extend credit to SMBs, you get the applicants to sign the personal guarantee along with their spouses.

- Generally, personal guarantees don’t really have much value but it’s better to have it. An owner of an SMB who refuses to affix his signature on a personal guarantee tells you something about him. Also, ask for the SSN of the person who will sign the personal guarantee. This makes it easier for you to track him down in case he tries to run away from his obligation.

- You may also want a clause that stipulates the customer paying interest on any past-due accounts and that they have to pay any legal, collection, and court fees incurred due to non-payment. Without this clause, you can’t collect any fees on debts if the case gets placed with collection agencies. If the case goes to litigation, the court in your locale will decide on the awarding of attorney fees, collection fees, and interests.

- You can have a clause which states that you want an assurance that the disputed amount of the past due only will get withheld.

- Should you decide to file a suit because of non-payment, you’d like it to be as easy as possible. Although most creditors request that the suit gets filed in their jurisdiction, this may not necessarily be in their best interest.

- Creditors should know that the customer’s assets are typically local to where they live. In cases where there is a need for post-judgment solutions, you must record the judgment in the local jurisdiction of the customer to attach the assets.

- You may consider an authorization from the customer to get information about them from banks, trade references, and credit bureaus before you authorize credit. This authorization extends once the applicant becomes your customer.

- You may also consider getting the financials of the applicants and their capacities to get financials in the future after they become customers

![37 Product Requirements Document Templates [Word] product requirements document template 04](https://templatearchive.com/wp-content/uploads/2024/02/product-requirements-document-template-04-270x180.jpg)

![34 Official Boyfriend Application Forms [PDF, Word] boyfriend application 33](https://templatearchive.com/wp-content/uploads/2022/07/boyfriend-application-33-270x180.jpg)